Fixing and Strengthening the

Fire District Mill Levy

A Correction to honor Voter Intent -

and an Increase to Sustain Emergency Services

What’s Happening?

Grand Lake Fire Protection District (GLFPD) is asking voters to approve two critical adjustments to our mill levy in the November 2025 election:

A CORRECTION to fully restore our previously approved 11.63 mills, which we have been unable to collect due to limiting language in the 2019 ballot measure.

A MODEST INCREASE to 13 mills, which reflects the real cost of continuing to provide timely, professional emergency services in a rapidly changing environment.

What We Do and Why It Matters

Grand Lake Fire Protection District (GLFPD) serves 105 square miles of northern Grand County, including the Town of Grand Lake and parts of Rocky Mountain National Park. We respond to structure and wildland fires, medical emergencies, vehicle accidents, water and ice rescues, and more — by land and by water — with a dedicated team of career and volunteer responders.

In addition to emergency response, we are deeply invested in prevention and education. This includes:

Free wildland home inspections and mitigation services

Monthly public safety classes

Youth outreach and community event participation

Life safety inspections in short-term rentals

Scholarship and community assistance programs

Our values — Professionalism, Integrity, Compassion, Honor, Courage, Dedication, Respect, and Commitment — are reflected in every call we respond to and every service we provide.

Why Is a Correction Needed?

In 2019, Grand Lake Fire Protection District voters approved a total mill levy of up to 11.63 mills to support the District’s operations. However, the ballot language included a clause that limited revenue collection to the lesser of 6.5 mills or $875,000, in addition to the base rate of 5.13 mills.

This “whichever is less” clause unintentionally created a structural cap on revenue growth. As assessed property values rise, the District reaches the $875,000 limit more quickly and must reduce the number of mills it collects—resulting in less overall funding than what voters intended.

For example:

In 2023, lower property values allowed the District to levy 10.41 mills to collect $1.81 million.

In 2025, higher property values meant the District could only levy 8.993 mills to collect $2.32 million, because of the $875,000 cap on the 6.5 mill portion.

In reality, our funding structure functions as 5.13 mills plus $875,000, not the full 11.63 mills that were approved. This limits the District’s ability to keep pace with rising costs, increased emergency call volume, and the long-term sustainability of fire and EMS services.

The correction being proposed in 2025 will remove the restrictive language and allow Grand Lake Fire to collect the full 11.63 mills that voters originally authorized. This adjustment aligns our actual funding with what was intended by voters, ensuring stable, predictable revenue as the District continues to serve a growing community.

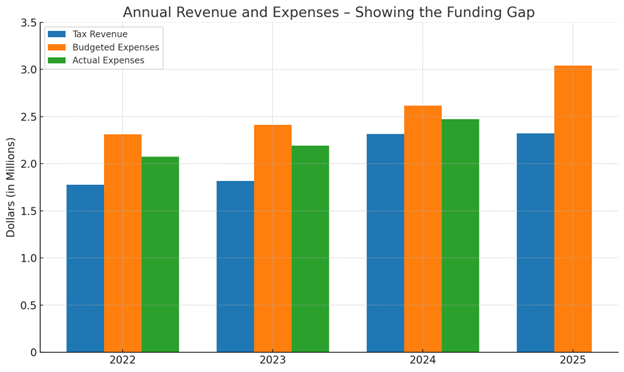

Why Is an Increase Needed?

Since that vote, the financial landscape has changed drastically. GLFPD is requesting an increase to 13 mills — a modest but essential adjustment to meet today’s demands:

Rising call volumes and staffing needs

PPE, or safety gear firefighters wear to protect themselves in a fire, costs have risen 40% in two years, and disruptions in global supply chains can have shipping delayed by up to 9 months.

Apparatus costs more than doubled since 2021

Below-average wages affect recruitment and retention

Supply chain delays now exceed 4 years for critical equipment

Legislative changes have limited tax revenue growth and lowered revenue rates.

How Recent Legislation Has Impacted Fire District Tax Revenue

In recent years, changes in state law have significantly affected how much property tax revenue the Grand Lake Fire Protection District can collect. These changes—primarily from Senate Bill 24-233 and the statutory 5.25% Property Tax Revenue Limit—were designed to provide relief to taxpayers in a time of rapidly rising property values and living costs.

We fully understand that lower assessed property values help keep taxes down for our residents and businesses. In a high-cost economy, this relief is welcome and important. However, these same measures also reduce the funding available for essential fire and emergency medical services, creating a challenge for the District to meet growing community needs.

-

1. Senate Bill 24-233: Lowering Property Valuations

Signed in May 2024, SB24-233 began impacting local governments at the start of the 2025 fiscal year. It reduces the valuation for assessment—the portion of a property’s market value that is taxable—for both residential and non-residential properties.

Non-Residential Properties

2022: Valuation was 29% of market value.

2025: Reduced to 27% of market value.

2026 and beyond: Reduced again to 25% of market value.

Residential Properties

2024: Reduced to 6.7% (after subtracting up to $55,000)

2025: 6.4% for all residential property

2026+: 6.95% (after subtracting up to 10% of value or $70,000, inflation-adjusted)

Lower valuations mean less taxable value, even when market prices increase.

-

The state has offered some reimbursement for revenue lost from earlier valuation cuts and for 2024 reductions in SB24-233, but:

2022 reimbursements were not received until 2024.

No advance details have been provided for 2023 or 2024 reimbursements.

Funding is limited, calculated using 2022 values, and not guaranteed in future years.

This makes reimbursements unpredictable and insufficient to offset long-term losses.

-

Beginning in 2025, the 4% annual growth cap on taxes is removed, allowing more homeowners to defer payment on a larger portion of their bill. While this benefits taxpayers, it delays the Fire District’s receipt of needed operating funds.

-

Starting in 2025, the statutory 5.25% Property Tax Revenue Limit caps annual growth in property tax collections at 5.25% over the prior year, with limited exemptions. Without voter approval to lift this cap, revenue growth cannot keep pace with inflation, rising equipment costs, and increasing emergency calls.

Lower property valuations provide needed tax relief for residents, especially as property values and expenses climb across Colorado. We fully support keeping our community’s tax burden reasonable.

However, these reductions—combined with the revenue cap and uncertain state reimbursements—also mean the Fire District’s ability to increase revenue is significantly constrained, even as we respond to more calls, maintain aging equipment, and face rising costs for staffing, fuel, training, and supplies.

Without adjustments—through voter approval or changes in state law—the District will be forced to continue doing more with less, which could impact future service levels.

How the Funds Will Be Used

The Grand Lake Fire Protection District is facing several ongoing challenges that directly impact our ability to provide the high level of emergency and public service our community expects and deserves. The funds from the proposed mill levy increase will be carefully allocated to address these critical needs. Click on the + sign to see more information.

-

As emergency calls rise in both frequency and complexity, additional funding will ensure we maintain adequate staffing levels and reduce reliance on mutual aid, helping us respond faster and more effectively.

-

Competitive wages and benefits are essential to attract and keep full-time, part-time, and volunteer firefighters and EMS personnel. This investment helps build a stable, experienced workforce capable of meeting our community’s growing demands.

-

Inflation and increasing prices for essential items—such as diesel fuel, insurance, and protective equipment—place a significant strain on our budget. The additional revenue will help cover these costs without compromising service quality.

-

The cost of fire apparatus and safety equipment continues to climb, with delays in manufacturing adding to the challenge. Funds will also support necessary fire station upgrades to meet evolving safety standards and service needs.

-

Reducing our reliance on borrowed funds and nonrenewable grants is vital for long-term sustainability. The new revenue will help stabilize our financial base, allowing us to plan more effectively for future emergencies and community needs.

Despite these pressures, the District’s leadership remains committed to responsible financial management and has made strategic improvements in services. This mill levy increase is a necessary step to protect the safety, health, and well-being of our community today and into the future.